Fatf Definition Of Trade Based Money Laundering

The idea of cash laundering is essential to be understood for those working in the financial sector. It is a process by which dirty money is transformed into clean money. The sources of the cash in actual are felony and the cash is invested in a approach that makes it seem like clear cash and hide the identity of the felony a part of the cash earned.

Whereas executing the financial transactions and establishing relationship with the brand new prospects or sustaining existing customers the obligation of adopting sufficient measures lie on every one who is part of the organization. The identification of such component in the beginning is easy to cope with instead realizing and encountering such situations afterward within the transaction stage. The central bank in any nation provides complete guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to discourage such conditions.

An obstacle to effective identification and disruption of Trade-Based Money Laundering TBML is a lack of understanding. The Financial Action Task Force FATF has conducted a new study to provide guidance to countries on measures they can take.

Trade Based Money Laundering Case Studies Compliance Alert

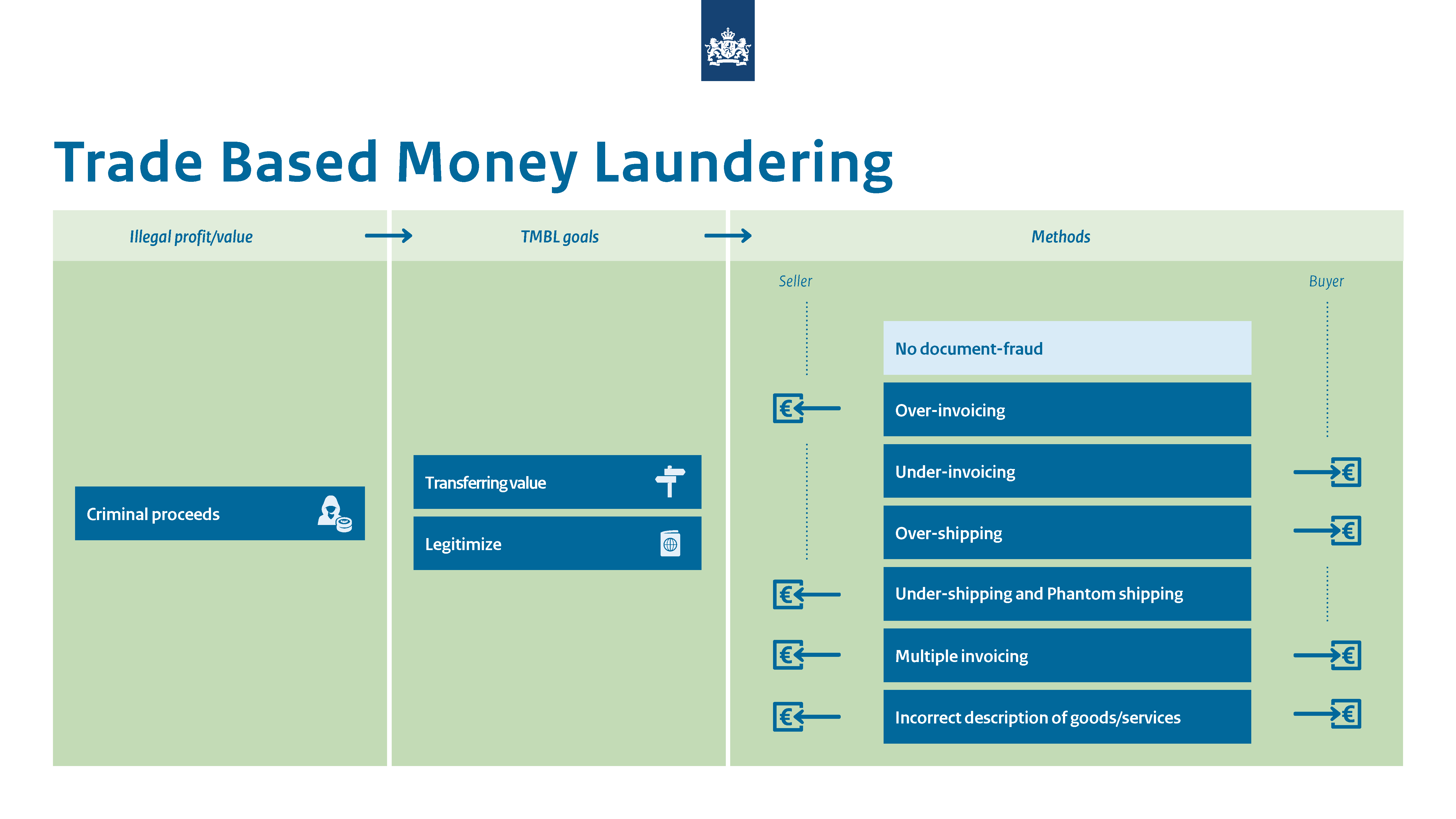

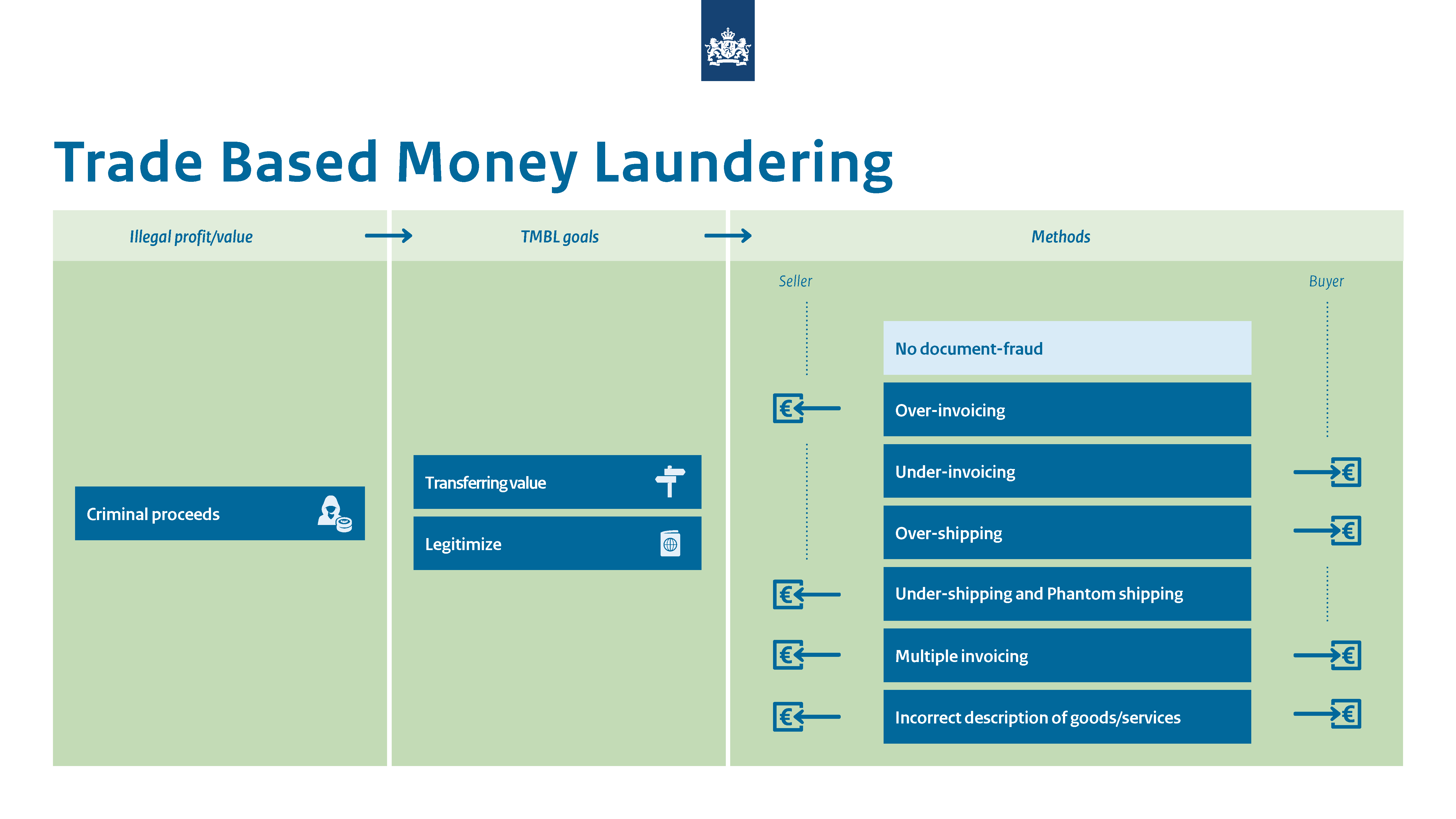

The term trade-based money laundering and terrorist financing TBMLFT refers to the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimise their illegal origins or finance their activities.

Fatf definition of trade based money laundering. Trends and Developments report. In this article we look at risks for freight forwarders and customs brokers identified in the recent paper¹ on TBML published by the Financial Action Task Force FATF and the Egmont Group of Financial Intelligence Units. For the purpose of this study trade-based money laundering is defined as the process of disguising the proceeds of crime and moving value through the use of trade transactions in.

In 2006 the FATF released the report entitled Trade-Based Money Laundering TBML in which it identified the three major methods used by criminal organisations and terrorist financers to move money for the purpose of disguising its origins and integrating it into the formal economy. By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics. Trade based money laundering has become a growing concern since the publishing of FATF report.

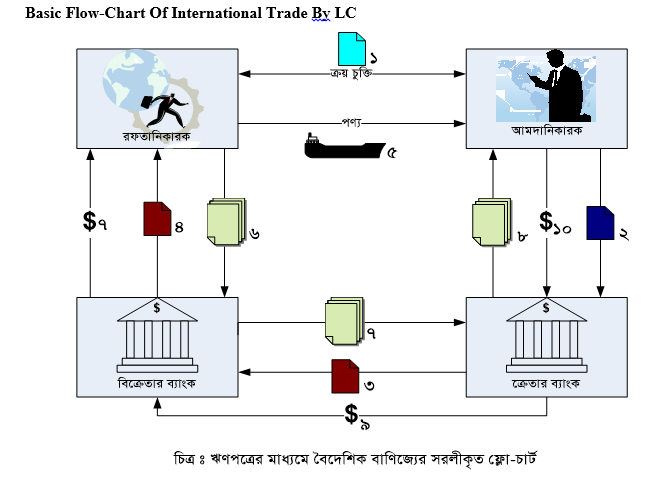

25 June 2020 The illegal wildlife trade is a major transnational organised crime which generates billions of criminal proceeds each year. Trade-Based Money Laundering TBML primarily involves the import and export of goods and the exploitation of a variety of cross-border trade finance instruments. According to the Study the international Financial Action Task Force or FATF has identified TBML as one of the primary means that criminal organizations use to launder illicit proceeds.

The Financial Action Task Force FATF is an independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering terrorist financing and the financing of. According to the Global Financial Integrity analysis from 2005-2014 the illicit cash flow to and from emerging and developing countries was 12-24 of their total trade. The Financial Action Task Forces FATF best practice paper on Trade Based Money Laundering is useful but it can be educational to look at an actual case study concerning money laundering and fraud to get a better understanding of the techniques perpetrators use and to.

The Financial Action Task Force FATF identifies four basic techniques of Trade-Based Money Laundering in a 2006 publication. Recommendations issued by the FATF define criminal justice and regulatory measures that should be. What is Trade-Based Money Laundering.

TRADE BASED MONEY LAUNDERING 01 Trade-based money laundering is defined as the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimize their illicit origins and to finance objected activities. To combat TBML firms should seek to strengthen their AMLCFT controls in trade finance and correspondent banking. Publication of the joint EG-FATF Trade-Based Money Laundering report.

2 About Trade-based Money Laundering Key Concepts 21 Trade-based money laundering was originally defined by FATF in 2006 as the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimize their illicit origins 22 The FATF Paper on Best Practices 2008 broadened. The Financial Action Task Force FATF is an independent intergovernmental body that develops and promotes policies to protect the global financial system against money laundering and terrorist financing. Financial Action Task Force FATF defines Trade Based Money Laundering TBML as the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimise their illicit origin.

Over and under invoicing of goods and services Multiple invoicing of goods and services Over and under shipments of goods and services. The Egmont Groups IEWG is proud to announce the publication of the joint EG-FATF Trade-Based Money Laundering 2020 Update. For the purpose of this study trade-based money laundering is defined as the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimise their illicit origins.

Along with some other aspects of underground economic activity rough estimates have been. Trade Based Money Laundering TBML risk in the freight forwarding and customs broking sectors.

What Is Trade Based Money Laundering Tbml

Pdf Trade Based Money Laundering And Terrorist Financing

Trade Based Money Laundering A Primer Institute Of International Banking Law Practice

Documents Financial Action Task Force Fatf

Trade Based Money Laundering Adalah Unbrick Id

Trade Based Money Laundering Typologies

What Is Trade Based Money Laundering Tbml Amlc Eu

Trade Based Money Laundering Gao Report Stresses Enforcement Challenges Money Laundering Watch

Trade Based Money Laundering Adalah Unbrick Id

Cams Afroza Everything You Need To Know About Trade Based Money Laundering

Https Www Gov Im Media 1348726 Notice 1000 Man Trade Based Money Laundering July 18 Pdf

Trade Based Money Laundering Adalah Unbrick Id

Definition Of The Three Stages Of Money Laundering Money Laundering Regards The Financial Transactions In Which Individuals Participating In Criminal Activity Try To Disguise The Proceeds Or Sources From These Transactions

Trade Based Money Laundering Tbml Aml Cft

The world of rules can seem like a bowl of alphabet soup at times. US money laundering rules are no exception. We've got compiled an inventory of the highest ten money laundering acronyms and their definitions. TMP Risk is consulting firm focused on protecting financial companies by reducing risk, fraud and losses. Now we have massive bank expertise in operational and regulatory danger. Now we have a robust background in program management, regulatory and operational risk in addition to Lean Six Sigma and Business Course of Outsourcing.

Thus money laundering brings many hostile penalties to the group because of the dangers it presents. It increases the chance of main risks and the chance price of the bank and finally causes the financial institution to face losses.

Comments

Post a Comment